Page 19 - Ghost Digital

P. 19

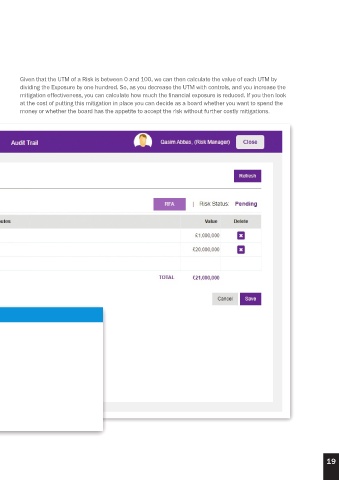

Given that the UTM of a Risk is between 0 and 100, we can then calculate the value of each UTM by

dividing the Exposure by one hundred. So, as you decrease the UTM with controls, and you increase the

mitigation effectiveness, you can calculate how much the financial exposure is reduced. If you then look

at the cost of putting this mitigation in place you can decide as a board whether you want to spend the

money or whether the board has the appetite to accept the risk without further costly mitigations.

Civil Prosecution

Criminal Prosecution

Damages paid to clients

Direct financial loss

Immediate loss of client contracts

Investigations / defence costs

Physical repair and replacement of Property

Regulatory fines - ICO, SRA, FCA, etc

Test Factor

Other

19